2021 – Here We Go Again

“A nickel ain’t worth a dime anymore.” Yogi Berra

The trend continues. Each year retirees await an October announcement of the Social Security cost of living adjustment (COLA) specifying how much Social Security Retirement Benefits will increase in the coming year. On the heels of this announcement, in November, Medicare announces how much of that pay raise will be eaten up by cost increases for Medicare Part B premiums (B premiums are taken directly from one’s Social Security retirement benefit). The trend has seen health care inflation driving a significantly higher Medicare price increase than the Social Security COLA. 2021 will be no different. Social Security COLA will be 1.3% with Medicare B premiums rising 2.7%.

At first glance, it appears that a 2.7% price increase is very modest. The national headlines will likely echo this sentiment. Medicare Part B premiums will increase from $144.60 per month to $148.50. However, the Continuing Appropriations Act H.R. 8337 passed by Congress in September 2020 limited any increase in Part B premiums to 25% of the actual cost. A back of the napkin calculation tells us that had the true increase, calculated by the actual cost the government incurs to run the program, been charged the cost increase would have been closer to 10%! Having the Medicare system absorb most of the true cost increase will only add to the enormous fiscal strain already faced by this program, likely leading to even larger price increases in years ahead.

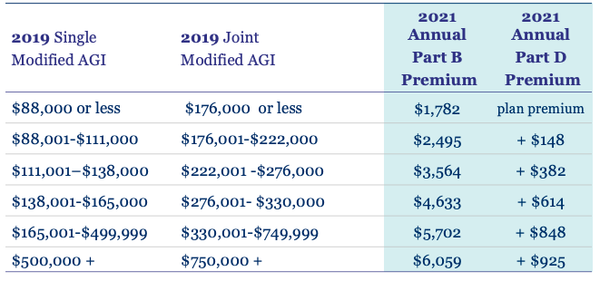

2021 Part B and Part D premiums are listed in the chart below. Remember that these premiums are determined by 2019 income so the new inflation adjusted income brackets are also listed.

- Connecting with your clients on the proper timing of Medicare enrollment, coverage selection and cost estimates will continue to be a critical piece of any comprehensive financial plan.

- High income earners can often lower Medicare premiums by avoiding the two year look back.

- 2021 employee benefit selections including the Roth 401(k) and Health Savings Accounts offer ideal ways to plan for retirement health care.

I’m glad to be of assistance with client phone consultations, group webinars and free educational resources.