Fall 2019 Newsletter – Medicare 2020

As we move into the fourth quarter it is important to track a few Medicare changes coming in 2020.

1. IRMAA brackets will be indexed for inflation.

2. Medigap plans C and F will no longer be available to new enrollees.

3. The Medicare Part D “donut hole” continues to phase out.

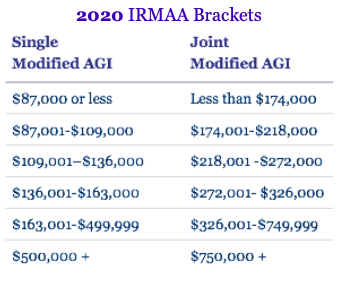

IRMAA (Income Related Monthly Adjustment Amount) brackets are used to determine the amount Medicare enrollees pay for Part B and Part D. As the name indicates, higher incomes trigger higher premiums. In 2020, the income thresholds will be indexed for inflation for the first time in 10 years. For the past decade, income growth plotted against the brackets pushed individuals into higher premiums. The change stands in stark contrast to the lowering of income thresholds created in the Affordable Care Act Legislation. The 2020 bracket is shown below. Remember that Medicare looks at income from two years prior in order to determine current year premiums. Also note that the top bracket will not be indexed and therefore stays the same next year.

Building sources of tax free and tax favored income in retirement from Health Savings Accounts, Roths, and tax deferred annuities continues to be a prudent strategy. Tax free income sources combined with higher income thresholds create increased opportunities to lower one’s Medicare premiums.

2. There are 10 standardized Medigap Plans available to enrollees. Two of these plans, Medigap C and Medigap F, which pay for the Part B deductible will no longer be offered in 2020. Medigap Plan F is a popular plan but 2020 enrollees can simply pivot to Medigap Plan G which covers the same items with the exception of the Part B deductible. This deductible is currently only $185 so the change is minor. Note that three states (MA, MN, WI) do not offer the 10 standardized plans but will see similar changes to their state offerings.

3.The Part D coverage gap known as the “donut hole” has been shrinking each year. This trend continues in 2020. After meeting your plan deductible and a certain amount of expenditures, Part D enrollees will pay no more than 25% of the plan’s cost for generic or brand name drugs.

| The information in this presentation is provided as a general overview. It is derived from the Internal Revenue Code, Medicare.gov and other government publications, all subject matter sources reasonably believed to be reliable. Tax law and the laws governing Medicare/Medicaid are complex and subject to change. Clients should consult with their attorney and/or qualified tax advisor when making decisions regarding these matters. |