March 2019 Newsletter

Early Retirement

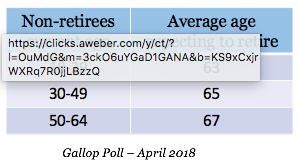

According to a recent Gallop Pole, as individuals grow older, plans for an early retirement tend to diminish. As we put pencil to paper to determine if financial resources will support expenses, the cost of living realities are striking. The largest expense in the center of this analysis is health care costs.

For those pursuing early retirement, it is critical to get a realistic health care cost estimate. Medicare enrollment prior to age 65 is only available to those with end stage renal disease, Lou Gehrig’s disease or those on Social Security disability. This means that in the absence of employer provided health care, normally we turn to the private insurance market. These policies are usually purchased on the Affordable Care Act health care exchanges (federal or state). You can also shop them directly with insurance carriers.

To examine the full offering in your county requires logging into the exchange and inputting detailed personal and financial information. For those who find this cumbersome, the Kaiser Family Foundation has created a very helpful short cut where one can input some basic information such as age, income, zip code, and the number of people on the policy: Kaiser Calculator

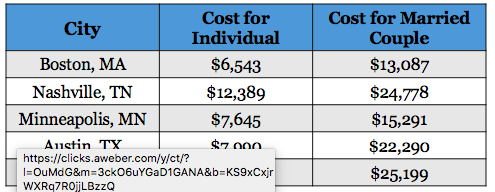

The chart below shows a random sampling from the Kaiser site detailing the cost for a Silver level health insurance policy. I assumed 2019 income for 60 year old non-tobacco users. The single person’s income is $48,561 and the married couple’s income is $65,841. Income below these thresholds could qualify you for a subsidy from the federal government. Note that “income” for this calculation includes Adjusted Gross Income plus tax-exempt Social Security Benefits, tax-exempt interest, and tax exempt foreign income.

As you can see, costs are substantial and can vary based on location. The costs in the chart above are just the annual plan premiums. Each plan would also have a deductible ranging from $3,000 – $6,000. After factoring in c0-payments, a married couple in Indiana could be budgeting close to $30,000 for annual health care expenses until they reach age 65 and can enroll in Medicare. If carrying these costs puts a strain on your financial plan, it probably is an indicator that early retirement is not prudent.

To find a more affordable option. Some individuals use short term health policies. These plans usually cover up to a 12 month period and can be renewed to a maximum of 36 months. The coverage is by no means as extensive as a traditional health policy. They are particularly challenging for those with pre-existing conditions and those who use many prescription medications. Short term health policies also have a life time maximum pay out.

The last alternative is to forgo insurance and utilize a cost sharing ministry. A description of these programs is beyond the scope of this newsletter. These offerings usually have membership standards (for example they may restrict membership to those of the Christian faith) and can exclude pre-existing conditions. They are, however, experiencing significant growth in membership.

For clients seeking early retirement, having a realistic health care coverage plan and cost is paramount.

Do you send out an e-newsletter? Email me to ask about including innovative video content on the convergence of health care and financial planning.pfstahl@bedrockresults.com

Peter Stahl CFP®

The information in this presentation is provided as a general overview. It is derived from the Internal Revenue Code, Medicare.gov and other government publications, all subject matter sources reasonably believed to be reliable. Tax law and the laws governing Medicare/Medicaid are complex and subject to change. Clients should consult with their attorney and/or qualified tax advisor when making decisions regarding these matters.